“Promoting Freedom in B.C.”

Freedom activists are critical thinkers!

Our society is so dumbed down and indoctrinated that

anyone who is a critical thinker is labeled as a

Conspiracy Theorist to avoid critical debates

Did you know: The term ‘conspiracy theorist’ was

first coined and used by the CIA to

ridicule anyone who opposed the

It is important to come out on Saturdays to oppose all Gov’t corruption

and support others. Visibility = Credibility.

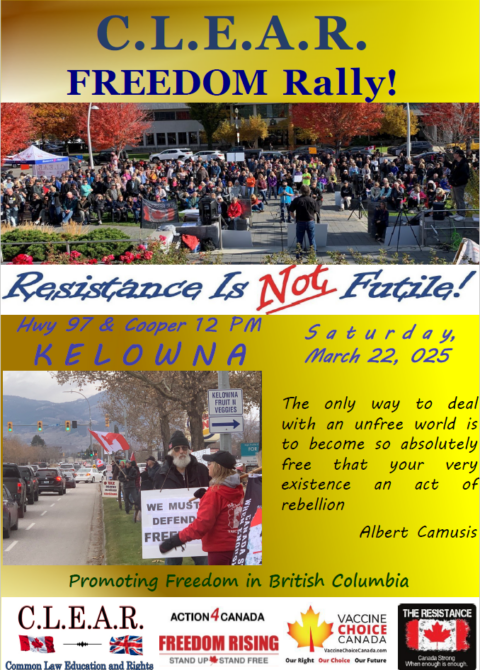

Next rally is:

Saturday

March 22, 2025

Hwy 97 & Cooper

Help us give away hundreds of Druthers every week to

supporting drivers!

April 5, 2025

Stuart Park!!

Courts

Falsified assault charge

Kelowna Courthouse

R v David Lindsay s. 266 Criminal Code Assault –

Appeal

Thank you for all your support and belief for freedom!!

Remember the Freedom Principle:

An attack against one is an attack against all.

An attack against all, is an attack against one.

Next Supreme Court Appeal Hearing Date:

April 9, 2025 9:00 a.m.

I have previously appeared before Justice Wilson, for a case

management hearing to determine how my appeal itself, will

proceed.

I have now filed a Constitutional Challenge to the transcripts

fees statutes and regulations, including the basis for same, and

relief I will be seeking. An amendment may have to be made to

include a statute I was unaware of. I will post this on our

website when it is complete, along with the response from

Jessica Patrick for the Attorney General in Victoria, who will be

dealing with this matter.

A date has been set for the week of August 11, 2025 to hear this

matter.

Two affidavits will be filed by February 28, 2025.

The Crown recently filed its response to my Challenge on the

Transcripts Extortion Fees they are charging for appeals.

Apparently, there has been a new change in the contract for

transcripts fees. Previously, the company with the contract had

exclusively rights to make these transcripts. The Crown alleges

that this provision has now been removed, and I can get

anyone, as long as they are registered with the Gov’t to produce

them, to make my Transcripts.

This is a bit too late however, as I needed this in October, 2023,

not now.

I am trying to do these myself and have them accepted by the

Court to avoid fundraising, however, this has proven to be

extremely time consuming. I have about another three days to

transcribe, and then have to ask the Court to accept them.

The Crown has acknowledged that if the Court accepts my own

Transcripts, that my Challenge will be moot and not required to

be heard.

Monday, April 14, 2025 10:00 a.m.

To continue hearing my application to have the probation order

stayed pending appeal.

Justice Wilson will be hearing my appeal.

Anyone who was in court or seen the videos played into

evidence, knows full well I am innocent.

That Crown Persecutor Grabavac would devote so much time

and effort into this relatively minor issue, shows the politics

underscoring this case.

Grabavac, as expected, did not finish his presentation of lies and

deception to the Court at our last hearing.

City of Kelowna v David Lindsay et al

Petition to Stop Rallies at Stuart Park

Court Adjourned – August 25, 2025

IMPORTANT LEGAL UPDATE – FREEDOM OF EXPRESSION CASE

Dear Supporters,

We want to provide you with a critical update regarding our legal battle

for freedom of expression.

Our three-day hearing, originally scheduled for the week of March 10,

2025, has been adjourned once again, likely until this summer. This marks

the second postponement, entirely due to scheduling conflicts in the

Supreme Court, as a criminal trial has been given precedence over our

civil proceedings—just as it was in December.

While we do not yet have a confirmed date for the hearing, we have been

asked to indicate our availability for late July, August, or September 2025.

We will keep you informed the moment a new date is set.

The City’s Legal Attack on Freedom of Expression

This case began when the City of Kelowna filed a Petition seeking an

injunction to shut down our rallies and ban us from key downtown

areas—the most effective locations for public demonstrations.

In response, we filed a comprehensive legal defense, including our

Response, supporting affidavits, and a SLAPP Application to strike down

the City’s injunction. This move completely blindsided the City, which had

not anticipated such a strong legal counteraction

Our documents in this case are located on our website at:

https://clearbc.org/david/

City of Kelowna documents and pleadings are now placed on our website

for public viewing:

https://clearbc.org/city-of-kelowna/

What Is a SLAPP Application?

https://www.bclaws.gov.bc.ca/civix/document/id/complete/statreg

/19003

A SLAPP (Strategic Lawsuit Against Public Participation) Application is a

legal mechanism designed to prevent powerful entities from silencing

public expression through litigation. In this case, the City—armed with

virtually unlimited taxpayer-funded resources—is attempting to suppress

our fundamental right to peaceful, public protest.

This is precisely the type of government overreach that SLAPP legislation

was enacted to prevent.

The City’s Dangerous Argument

The City of Kelowna’s position represents one of the most dangerous

attacks on free expression in Canada. Their argument is that without a

permit to use sound equipment, our protest is not truly a protest—it is

merely a silent gathering, or event as they falsely term it.

This logic undermines the very foundation of free expression. Requiring

a permit for protest implies that protesting is banned by default, unless

explicitly approved by the government.

However, the Supreme Court of Canada (SCC) has repeatedly ruled that

freedom of expression includes not just the right to speak—but the right

to be heard.

To illustrate this, we played a video of David speaking at our Freedom

Rally when our generator went out—immediately, people could no

longer hear his words. This proves what we all know: effective public

expression requires the ability to communicate clearly, which includes,

indeed, requires the use of sound equipment.

Furthermore, both the SCC and lower courts have consistently upheld

that public parks, streets, and sidewalks are Constitutionally protected

places for peaceful protest. Even the RCMP has acknowledged that our

demonstrations have been entirely peaceful.

City’s Flawed & Misleading Claims

The City argues that our demonstrations qualify as an “event,” which

under their bylaws requires a permit. However, the term “event” is not

even defined in their bylaws.

Their position is based solely on:

- Our use of sound equipment

- The presence of our CLEAR canopy, which they have falsely labeled

as a tent - Allegations that CLEAR and David were selling merchandise

These weak and arbitrary claims do not—and cannot—turn a lawful

protest into a licenced “event.” Even if certain bylaw infractions were

alleged, that does not justify stripping us of our Constitutional rights.

Additionally, the City has provided no evidence that David or CLEAR were

selling anything. Only that other people were. And I have not been

deputized by the City to enforce their bylaws, as former Bylaw Manager

Kevin Mead admitted.

Not to prejudge, but the Justice in this case, I believe has already

recognized that the City is going no where with their claim that our CLEAR

Canopy is an alleged, “tent”.

In effect, the only thing the City really has in evidence that we were

allegedly holding an undefined “event”, is that we used sound equipment

and advertised our Freedom Rallies.

All protests involve advertising or they would never take place. This is an

absurd, and indeed, stupid argument.

The use of sound equipment is what is legally known as “necessarily

incidental” to our freedom of expression. Without the sound equipment,

we could not effectively communicate, and at times with many people,

not at all.

By doing this, the rallies become more of a social function, than a

protest, because no one can effectively communicate to everyone

else.

Our SLAPP Application: A Strong Legal Defense

Our SLAPP Application is incredibly detailed and well-prepared. As the

legal maxims state: “Fraud lurks in generalities”, and, “the details make all

the difference.”

The City’s strategy is clear:

- Ignore Constitutional law and attempt to redefine protesting as a

regulated activity. - Gloss over key legal principles and hope the courts accept their

broad, unfounded claims. - Bylaw us out of existence—forcing us away from public spaces and

out of the public eye.

But we refuse to be silenced.

We knew we had to be meticulously prepared, with extensive evidence

and legal arguments to counter every false claim. And we are prepared.

The Broader War on Free Speech

This case is not an isolated attack—it is part of a coordinated effort to

suppress free expression across Canada, particularly in British Columbia

and Alberta.

- Online censorship is expanding.

- Private interest groups, funded by the government, are targeting

businesses that support free speech, threatening them with

boycotts and false accusations. Many businesses break contracts

with us at the last minute out of fear. - Municipal governments are being weaponized to push freedom

advocates out of public spaces. - And most recently under the Communist Liberal Government,

ongoing refusals to permit certain media outlets into their press

releases and government functions, to ensure only Liberal

Government supported media is allowed in.

Their tactic is simple: Out of sight, out of mind. If they can erase us and

our messages from public view, they believe they can stifle dissent.

Why This Fight Matters

Our Kelowna public rallies have empowered thousands to get involved in

defending freedom. The truth we have exposed has reached all corners

of British Columbia, shedding light on the deceptions of government

officials.

Just in the past six weeks: - Three complete strangers have approached me, expressing their

gratitude for what we have done. - One person emphatically stated, “There are thousands of people

supporting you.” - A public health employee confided that many of their colleagues

supported us but were too afraid to speak out.

These silent supporters will only be able to stand with us if we remain in

the public eye.

Requiring a government license to protest is unacceptable. If we comply,

we further surrender our right to spontaneous demonstrations, which are

at the heart of effective activism.

How You Can Help

This is one of the most important free expression cases in Canada. Only

three provinces have SLAPP legislation similar to what we have in British

Columbia.

We need your continued support—legal battles like this require time,

effort, and resources.

If you believe in freedom of expression, there are three ways you can help:

time, energy or financial. Please choose at least one to contribute to our

case and our Freedom Rallies.

Next Steps: Stay Engaged

As soon as the courts provide us with new hearing dates, we will notify

you immediately. Please show up at court and voice your support of our

position

In the meantime, spread the word, stay informed, and stand with us. The

fight for freedom of expression is far from over—but together, we will

prevail.

The BC Government will use this case, via its municipalities, to eventually

shut down all public protests, if we lose. Make no mistake, despite the

City’s colourable guise of claiming it is only bylaw enforcement and they

don’t care what we talk about, this is an outright lie. The only person

charged with having public rallies is David – despite dozens of other

protests using sound equipment over the years on other topics that either

supported the governments or were non-threatening to them.

CLEARLY, our rallies have had far more success behind the scenes, than

we can see. Our signs, some of the best, including LOCK HER UP –

Bonnie Henry, remain some of the strongest signs voicing not only our

opposition to what these Government people have done, but demanding

accountability.

Thank you for your unwavering support.

Tamara Lich and Chris Barber decision expected next month

https://politicalscorecards.ca/

https://politicalscorecards.ca/election-integrity-survey-

results/

chrome-

extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.jccf.c

a/wp-content/uploads/2023/04/Digital-ID-Surveillance-and-the-

Value-of-Privacy_Justice-Centre-for-Constitutional-Freedoms.pdf

Dr. Trozzi and Ted Kuntz

Wins of the Week – #64

https://www.drtrozzi.news/p/wins-of-the-week-ep64-with-ted-

kuntz?publication_id=1972999&post_id=159154153&isFreemail=tr

ue&r=1ri3is&triedRedirect=true&utm_source=substack&utm_medi

um=email

Action4Canada

Next Empower Hour: March 19, 2025

Next Empower Hour: Michelle Stirling

Topic: Native Pawns – Cheque Mate

Sign on starts at: 4:30pm PST/7:30pm EST

Be sure to Register in Advance and invite others.

Join us! Share this page and link with your friends and social media!

This week on the Empower Hour Michelle Stirling, author, researcher,

columnist and blogger, joins Tanya Gaw to further expose the native

activists and government proxies who are fraudulently using the so-called

Truth and Reconciliation as a pretext to justify a massive wealth transfer,

land grabs and to steal our natural resources. This is in accordance with

the global elites’ lust for power and money, and the World Economic

Forum’s (WEFs) plan to rob every citizen of their belongings. As Klaus

Schwab so infamously put it, “you’ll own nothing and be happy“.

The media and global government operatives are using textbook, military

style psychological warfare to achieve their goal as they attempt to

deceive citizens into believing that European Canadians are evil, white

colonialists who stole the land from the Indians and murdered thousands

of innocent children and that the price we must all pay is to repent and

be forced to make never-ending reparations for past sins, by

relinquishing our hard-earned tax dollars and property.

Michelle Stirling’s extensive research is exposing the lies and providing

facts and insights into what is really going on. You will not want to miss

this Empower Hour so be sure to sign up in advance and invite others.

Are you finding it hard to make ends meet and frustrated with the Liberal

government pandering to minority groups, whilst victimizing them and

giving BILLIONS of your hard-earned tax dollars to opportunists and

extortionists? Make no mistake, what we are witnessing is criminal and it

must be stopped. In order for this to happen Canadians need to stop

apologizing, educate themselves and make this a key election issue.

Hundreds of billions of dollars have been paid out to date for Indian land

claims and claims of mistreatment at Residential Schools resulting in a

so-called genocide, based on fallacious accusations by Indian activists

that children were missing or murdered and placed in mass graves.

The problem is that there are no historical records or police reports of

parents frantically searching for their missing children. However, there are

well-documented and extensive records that prove the opposite. In fact,

most of the deceased in the community graveyards (like Cowessess) are

local pioneer families – generally, children who died AT an Indian

Residential School (423 deaths at 139 schools over 113 years) were sent

home for burial ON RESERVE!

Michelle Stirling and other researchers have provided copious amounts

of evidence to counter the lies regarding land rights and to show that the

majority of schools were a safe haven for the majority of children,

including the many orphans who would have otherwise been left to fend

for themselves. Many Indians have also provided personal testimonies

saying how grateful they were to have received an education, medical

care and nutritious meals. But you won’t hear about any of this being

reported by the mainstream media.

The truth is that the Indians are being used as pawns in order to advance

the Global Agenda and if we truly care about them, we will boldly speak

out and work towards all Canadians being treated equally, in accordance

with the Constitution.

Examples of current land grabs and fraud:

- February 1, 2025: BC Premier David Eby is working on moving

forward on transferring the power over Crown Land to the natives.

Which is 95% of BCs land. - Jan 27, 2025: Millions in federal funds to recover suspected Indian

children’s graves in BC went elsewhere. Question: Should there be

an investigation into this fraud and those that were involved,

charged? - January 24,2025: Land-transfer finalized in agreement between

Mission, province, First Nations - February 5, 2025: New Brunswick Aboriginal title has become a

constitutional threat in Canada

•

This global campaign is an existential threat to Canada’s

sovereignty. Make this an election issue. Share the following report with

the elected officials in your area and request they respond. The Canadian

Systemic Racism Ruse: Truth and Revelation.

Remember the Freedom Principle:

An attack against one is an attack against all.

An attack against all, is an attack against one.

Guidelines for Peaceful Protesting/Gathering/Rallies and/or Attending

Events (eg. Council Meetings, School Boards, Handing out Flyers)

https://action4canada.com/know-your-rights-guidelines

Check out A4C for some of the most successful actions and

strategies available to us!

And a big thank you to Tanya for all her hard work and dedication

and support for the Christian principles that founded our nation!

https://action4canada.com/

See recent National Citizens Inquiry Presentations in

Edmonton:

https://rumble.com/user/ncicanada

https://rumble.com/v6qdxy8-theo-fleury-from-despair-to-hope-a-

story-of-survival.html?e9s=src_v1_upp

https://rumble.com/v6q5c1c-an-injection-of-truth-2-dr.-david-e.-

marin-from-01d.html?e9s=src_v1_ucp

https://rumble.com/v6q4i8w-an-injection-of-truth-2-dr.-gary-

davidson-from-01d.html?e9s=src_v1_ucp

https://bcrising.ca/hpoa/

Recently, Katie and her family obtained an injunction in the

Federal Court against the cull of these wonderful animals. A

judicial review of the Canadian Inspection Agency’s decision to

cull these animals will now take place at some future date.

Meanwhile, the Inspection agency has applied to have this

hearing expedited.

The Judge has decided to make a ruling based on written

submissions only, so there will be no open court hearing on this

issue. This is likely either this week or next week.

An appeal has apparently been filed in the Federal Court of

Appeal.

Please keep the support ongoing!

https://druthers.ca/

CASH UPDATES

In a mixed set of updates here.

CBDC Updates:

https://libertysentinel.org/exposing-trumps-true-character/

Canadian reporter Alex Newman explains what gov’ts around the world

are doing with CBDCs right now.

India: advertising about banning Bitcoin

Kuwait: Forced over 1 million citizens to hand over their bio-metric

data (including fingerprints) and suspending services if they do not do

so, including withdrawing or transferring money.

Date for this was Sept. 30.

35 000 bank customers suspended from using bank services

England: Bank England is preparing to force digital currencies if the

banks do not do so.

93% of Central Banks in the world are working on a CBDC – this is truly

frightening.

USA: House of Representatives voted to pass a bill, The Anti-

Surveillance State Act, 216-192, prohibiting the Federal Reserve from

issuing a CBDC. It is concerning however, many still voted against this.

Florida: Passed a law banning CBDCs!

Support Protection of Cash Now – in Parliament!

Bill C-400

SUMMARY

This enactment provides for the development and implementation of a

framework to ensure that cash continues to be available throughout

Canada.

It also amends the Currency Act and the Bank of Canada Act to remove

the Governor in Council’s power to call in coins and notes. Finally, it

amends the Bank of Canada Act to prohibit the Bank of Canada from

issuing a digital form of the dollar.

https://www.parl.ca/documentviewer/en/44-1/bill/C-400/first-

reading

https://preventgenocide2030.org/keep-cash-alive-support-bill-c-

400/

The Bank of Canada (B of C) has recently announced plans to suspend

introduction of a Central Bank Digital Currency (CBDC) to the public.

https://www.kitco.com/news/article/2024-09-20/bank-canada-

suspends-plans-introduce-cbdc-public

While this may sound victorious on its face, and there is much positive to

say when such plans are shelved or put on hold, please remember the

use of the word “suspend” as opposed to “cancel”.

Has the B of C simply decided to wait on the outcomes and research from

other countries and then simply tag along?

In this past summer, the B of C was recommending Canada provide its

own CBDC for digital payments. This apparently has been suspended or

now put on hold. We can only hope for some permanency to this

decision.

We need a Constitutional amendment that 100% absolutely provides for

the mandatory use and acceptance of cash for all transactions – in any

amount. So, if you wish to pay $1 000 000.00 for a house in $100/bills,

you should be allowed to so do. That is privacy.

Conversely, Google has announced that the Google Wallet can now

function as digital ID, based on the selling point of course, of convenience

to the exclusion of all privacy. Once privacy is lost, so is freedom.

“Imagine starting a vacation like this,” Google Wallet executive Alan

Stapelberg wrote in a blog post last week. “You arrive at the airport

and breeze through security by tapping your phone to a reader,

scanning your boarding pass and ID. While waiting to board, you

grab a drink at an airport bar, tapping your phone to prove your age.

When you arrive at your destination, you find your rental car and

leave the lot without stopping for an in-person ID check because you

already provided the necessary information in the rental car app. You

check into your hotel online and your key is issued straight to your

digital wallet. You do all of this with your phone — no physical wallet

required.”

https://www.thegoldreport.com/news/google-announces-digital-

id-wallet

Though a bit late, in June, 2024, Norway passed legislation

requiring use of cash!

https://x.com/petersweden7/status/1843050565443395924?s=52

Yes to cash

https://x.com/jackunheard/status/1843056003497218451?s=52

In one of the most comprehensive reports to date on the

issue of CBDC, the JCCF has just published: Central Bank

Digital Currency? – What it is and how it could impact your

privacy, security, and autonomy

https://www.jccf.ca/wp-

content/uploads/2025/03/CBDC_Final-Report_March-

17_Justice-Centre-for-Constitutional-Freedoms.pdf

REMINDER

New Credit Card Fees & Lack of Privacy

It is starting – Use cash as much as possible – use credit cards or

digital only if there is no other alternative.

The Bank of Canada is admittedly planning for digital currency.

It claims that it will not replace cash – BUT – and here is the

caveat, it will continue to use cash “notes for as long as

Canadians want them.”

In other words, if you don’t use cash, you will lose it. Reading

between the lines, it is clear that the Gov’t will simply issue press

releases and polls showing most Canadians don’t use and/or

don’t want cash, and then the Bank of Canada will claim it has

to eliminate cash because few people are using it or want it, and

it is, ironically, too costly to maintain printing the notes and

coins.

https://www.bankofcanada.ca/digitaldollar/#what-digital-

canadian

Bill Still, the US Patriot and author of the incredible

documentary, The Money Masters, outlines the results of recent

polls showing that 86% of Canadians fear the digital dollar!!!

Wow.

87% of Canadians have heard or are aware of the Bank of

Canada’s CBDC (Central Bank Digital Currency), and 82% are

strongly opposed to it!!

https://www.thestillreport.com/post/bank-of-canada-

survey-86-fear-digital-dollar-the-still-report-episode-4280

Companies will not use digital currency if we are not using

digital currency!

It will cost them too much in lost business.

Here are two awesome posters that you can distribute to all

businesses to put on their entrance doors, advocating for the

use of cash. Print on 8 1/2 x 11 glossy hard stock for best

results.

For Business owners:

The dangers of digital gov’t ID and currencies are here… you need to use

cash as much as possible. As recognized by Freedom Rising, there are

many inherent dangers of using digital currency. What do you do, not if,

but when:

The internet is down

There is a power outage

The card reader malfunctions

Your phone battery dies or doesn’t work for other reasons

WE SUGGEST YOU CONSIDER THE FOLLOWING AS WELL:

Your phone is stolen

Your passwords are co-opted

Your credit/debit card strip is damaged – needs replacing

There are errors in relation to the quantum of $$ on your card

Gov’t limits your purchases/CRA liens the balance on your card

AND MANY OTHER DANGERS

CLEAR has promoted the non-use of digital currencies and

credit/debit cards as much as possible, for years.

Suggested Solution:

Withdraw money on Saturday/Sunday from the bank or bank

machine, and then leave your money at home if you are scared

to carry it with you, and just carry the amounts of cash for each

day’s purchases for the week.

NO MORE CARDS!!!! NO EXCUSES!

USE CASH $$$$$$$$$

Do you want to be the next person to be

“unbanked” because of your political

beliefs????

Another sample: (thanks Adele)

Get these cards below at the CLEAR booth to give out every

time you use cash – or print your own to hand out!

Make Business sized cards to hand out at

all your cash purchases!

Sunday Paper

Deliveries

Next delivery

day:

Sunday, March 2,

2025

(Weather Permitting)

Capril Mall, Gordon & Harvey St. (Hwy 97)

A small group of dedicated volunteers have been spreading the truth

via Druthers deliveries every Sunday for over 2 years now. This is one of

the most powerful things a freedom activist can do to help inform the

public. We meet every Sunday in the Capri Mall parking lot between

A&W and DeDutch Pannekoeke House.

Please note that if you have chosen to “fall back” to end Daylight

Savings Time, meet-up time will be at 9:30 am for you until the

government tells you to spring forward again in March. For those who

don’t adhere to this senseless ritual, Druthers deliveries will

continue to be at 10:30 am, Daylight Savings Time, all year long.

Thank You!

CLEARBITS:

Dr. Hoffe and Lee Turner: Bonnie Henry knew vaccines were

NOT safe and effective.

https://freedomandinvesting.substack.com/p/review-of-foi-

f23-1799-part-1?triedRedirect=true

Aboriginal title has become a constitutional threat in

Canada – Bruce Pardy – Law Professor

https://www.fraserinstitute.org/commentary/aboriginal-

title-has-become-constitutional-threat-canada

The attack on Christianity continues…

EXCLUSIVE: Three cities that proclaimed Christian Heritage Month

refuse in 2025

https://www.westernstandard.news/news/exclusive-three-cities-

that-proclaimed-christian-heritage-month-refuse-in-2025/63120

UBCO bars students from creating Conservative club — Liberal club

a-ok

https://www.westernstandard.news/news/ubco-bars-students-

from-creating-conservative-club-liberal-club-a-ok/63056

Muslims are taking over England as King Charles commits treason

and breaks his Coronation Oath

‘Trust in Allah’ Signs Blanket London as King Charles Hands Out

Ramadan Treats.

https://thenationalpulse.com/2025/02/27/trust-in-allah-signs-

blanket-london-as-king-charles-hands-out-ramadan-treats/

https://x.com/starknakedbrief/status/1890734832788881777?s=46

&t=5aDeE9N4pxwK8SIBoyTzOA

BC Conservatives have introduced a Bill into the Legislature to

prevent future time changes and leave this on permanent daylight

savings time (summer time).

Call your MLA and tell them to vote for this!

https://www.leg.bc.ca/parliamentary-business/overview/43rd-

parliament/1st-session/bills/1st_read/m206-1.htm

https://www.westernstandard.news/news/about-time-rustad-

introduces-bill-to-end-biannual-clock-changes-in-bc/63105

Chart of the Day (CotD) Canada Digital Currency PANOPTICON, by

Eldric Vero

https://www.eastonspectator.com/2025/03/16/chart-of-the-day-

cotd-canada-digital-currency-panopticon-by-eldric-vero/

More information on central bank digital currencies and their

effects. 86% of Canadians opposed CBDCs.

https://tnc.news/2023/11/30/canadians-oppose-bank-of-canada-

digital-currency/

https://www.jccf.ca/reports/

A glimpse into China’s digital spying regime

https://action4canada.com/digital-id-resources/

More attacks on Freedom of Expression in Calgary and Edmonton –

Gov’ts using bylaws to deny freedom of expression unless a permit

is obtained – your freedom is now a licenced activity in Alberta –

We need to win our Kelowna case later in August, 2025!!

https://www.westernstandard.news/news/edmonton-protest-

bylaw-faces-legal-challenge-over-charter-

violations/62428?utm_source=website&utm_medium=related-

stories

A real Canadian Carney-val!!!

Learn more about Mark Carney – the self-admitted Globalist

https://candicemalcolm.com/carney-

lies/?utm_source=substack&utm_medium=email

https://www.westernstandard.news/opinion/hannaford-theres-a-

lot-mark-carney-has-written-that-he-doesnt-care-to-talk-

about/62948

https://stand4thee.com/f/say-no-criminal-carney

https://www.eastonspectator.com/2025/02/16/carney-says-he-is-

an-elitist-and-a-globalist-which-is-exactly-what-canada-needs-not-

sure-youre-supposed-to-say-that-mate/

The COVID-CON continues to unravel with more Gov’t admissions:

https://childrenshealthdefense.org/defender/germany-knew-

covid-lab-leak-early-2020-hid-evidence-from-public/

The European Court of Justice considers that doctors will be solely

responsible for the consequences of covid injections because they

were free to refuse to inject

https://www.europereloaded.com/european-court-of-justice-

doctors-will-be-solely-responsible-for-the-consequences-of-covid-

injections/

https://www.buongiornosuedtirol.it/2025/02/19/esclusivo-vaccini-

covid-la-corte-ue-serviva-la-prescrizione-e-il-medico-poteva-

I warned people everywhere about Rustad from the beginning.

Now it appears at least three Conservatives have jumped ship

because of Rustad and the intentional voting irregularities that

occurred at the recent Conservative meeting in Nanaimo.

https://globalnews.ca/news/11074548/3-bc-conservatives-

independents/?utm_source=NewsletterBc&utm_medium=Email&ut

m_campaign=2025

https://globalnews.ca/news/11071997/dallas-brodie-booted-from-

bc-conservatives-over-residential-school-

comments/?utm_source=NewsletterBc&utm_medium=Email&utm_

campaign=2025

https://www.rebelnews.com/true_blue_trio_breaks_silence_followin

Freedom Rallies

Visibility = Credibility

“It ain’t over till it’s over”

Next Kelowna Rallies:

Saturdays 12:00 noon

March 22, 2025

Hwy 97 & Cooper

April 5, 2025

Stuart Park!!

Join us for important announcements on the

local, legal scene, and informative speakers!

March 5, 2025 12:00 noon

Vernon Freedom Rally

12:00 p.m. – 2:00 p.m. @ Polson Park

Join Ted for the Largest rally in the North

Okanagan, and growing weekly!

North Okanagan Shuswap

Freedom Radio

http://s1.voscast.com:11464/stream

March 5, 2025 12:00 noon

Kamloops Freedom Gathering

Valleyview Centennial Park

March 5, 2025 12:00 noon

O.K. Falls Freedom Rally

11:30 a.m.

Across from Esso Station

March 5, 2025 12:00 noon

Oliver Freedom Rally

12:00 p.m.

Town Hall

CLEAR Telegram

With almost 530 members now and growing, join us in

our C.L.E.A.R. Telegram group! Please remember: no

foul language, abuse or vulgarity for any posts, keep

posts relevant to today’s freedom issues, humour is fine,

be respectful at all times. Government officials, police,

agents or their posts are not accepted nor permitted on

this site. Please ensure as best you can, that material you

post is accurate and correct. Posting false or incorrect

information is not acceptable.

Help us ensure all posts are verified for correctness.

Opinions and discussions on relevant issues are also

encouraged.

This is a private group for trusted people and friends

only.

https://t.me/+SWxndPh1I9F2Iu-q